Our Company

Warner Bros. Discovery is a leading global media and entertainment company that creates and distributes the world’s most differentiated and complete portfolio of content and brands across television, film and streaming. Available in more than 220 countries and territories and 50 languages, Warner Bros. Discovery inspires, informs and entertains audiences worldwide through its iconic brands and products including: Discovery Channel, Max, discovery+, CNN, DC, Eurosport, HBO, HGTV, Food Network, OWN, Investigation Discovery, TLC, Magnolia Network, TNT, TBS, truTV, Travel Channel, MotorTrend, Animal Planet, Science Channel, Warner Bros. Motion Picture Group, Warner Bros. Television Group, Warner Bros. Pictures Animation, Warner Bros. Games, New Line Cinema, Cartoon Network, Adult Swim, Turner Classic Movies, Discovery en Español, Hogar de HGTV and others.

Latest News

Spotlight

Godzilla X Kong: The New Empire

In Theaters Now.

Furiosa: A Mad Max Saga

Only in Theaters May 24.

The Sympathizer

New episodes Sundays at 9pm on HBO.

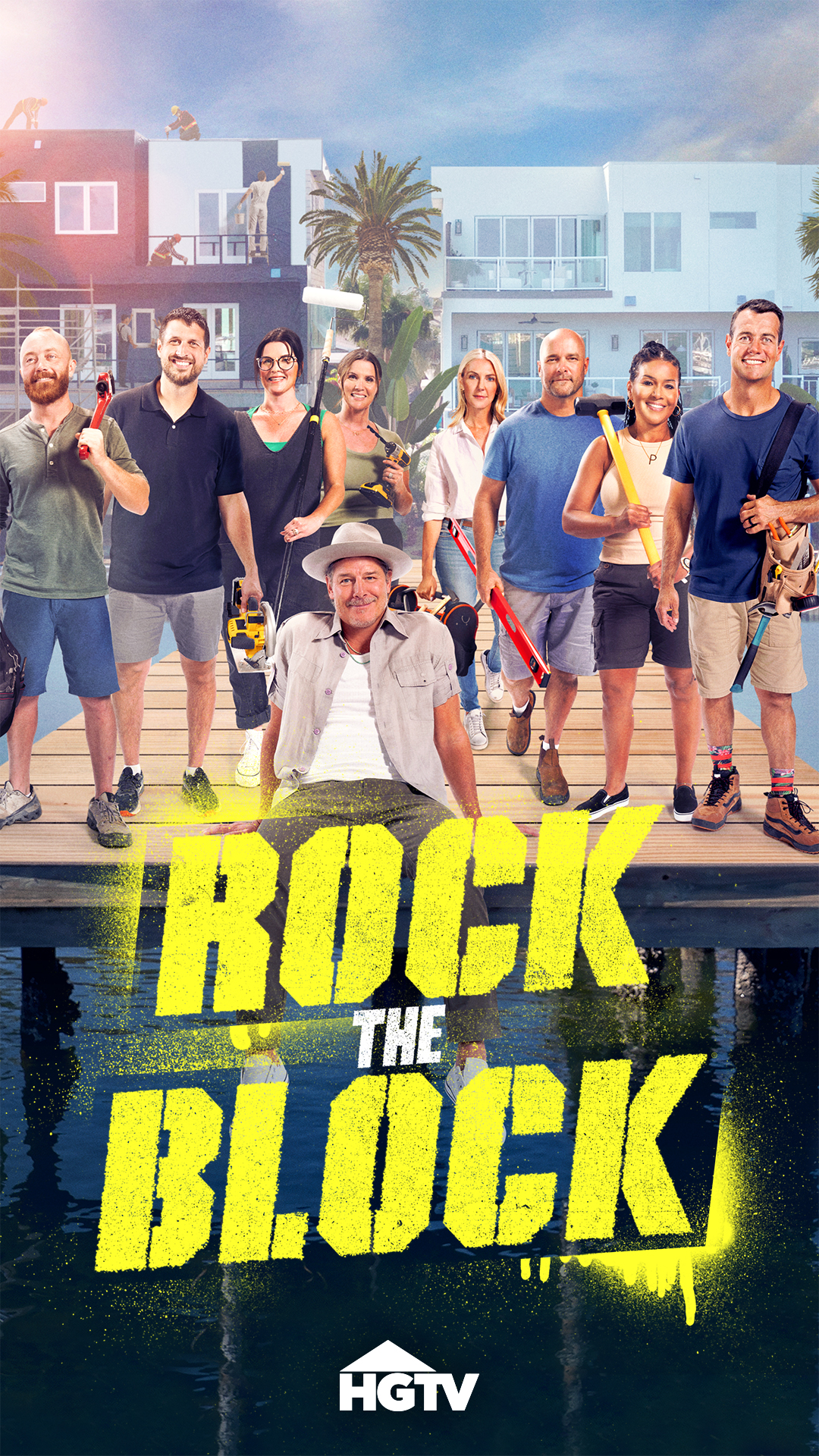

Rock the Block

New episodes Mondays at 9pm on HGTV and Max.

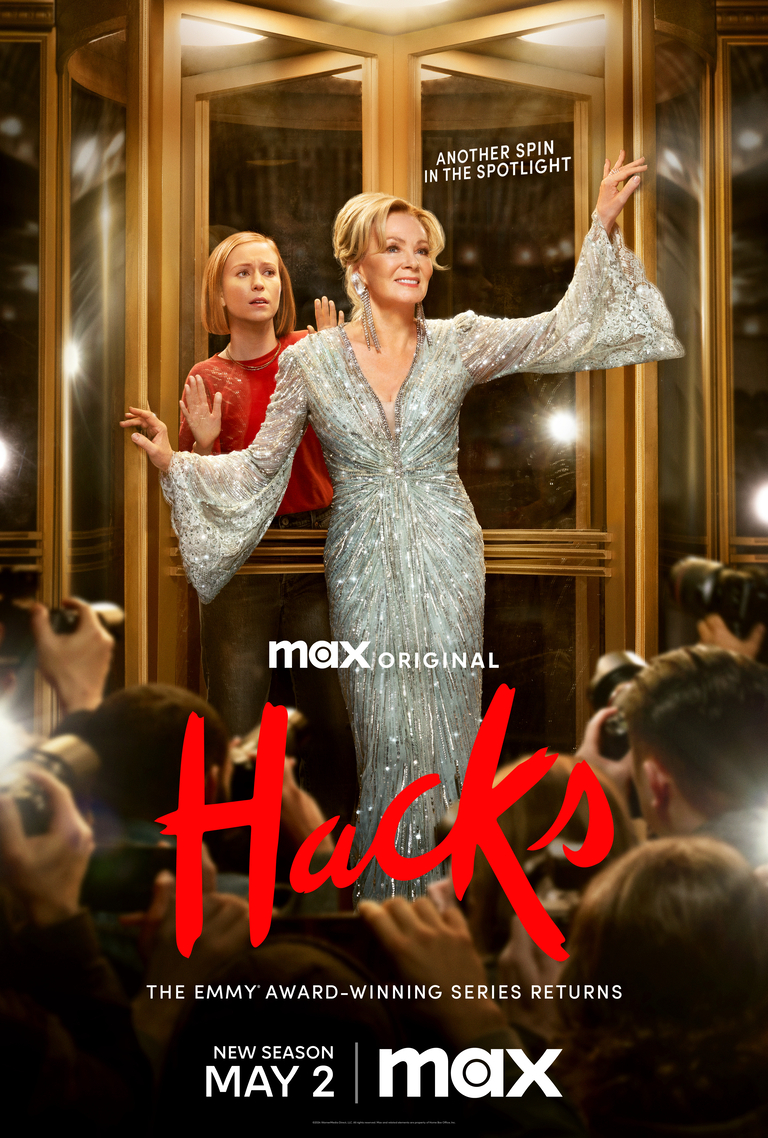

Hacks

Premiering May 2 on Max.

Conan O’Brien Must Go

Premiering April 18 on Max.

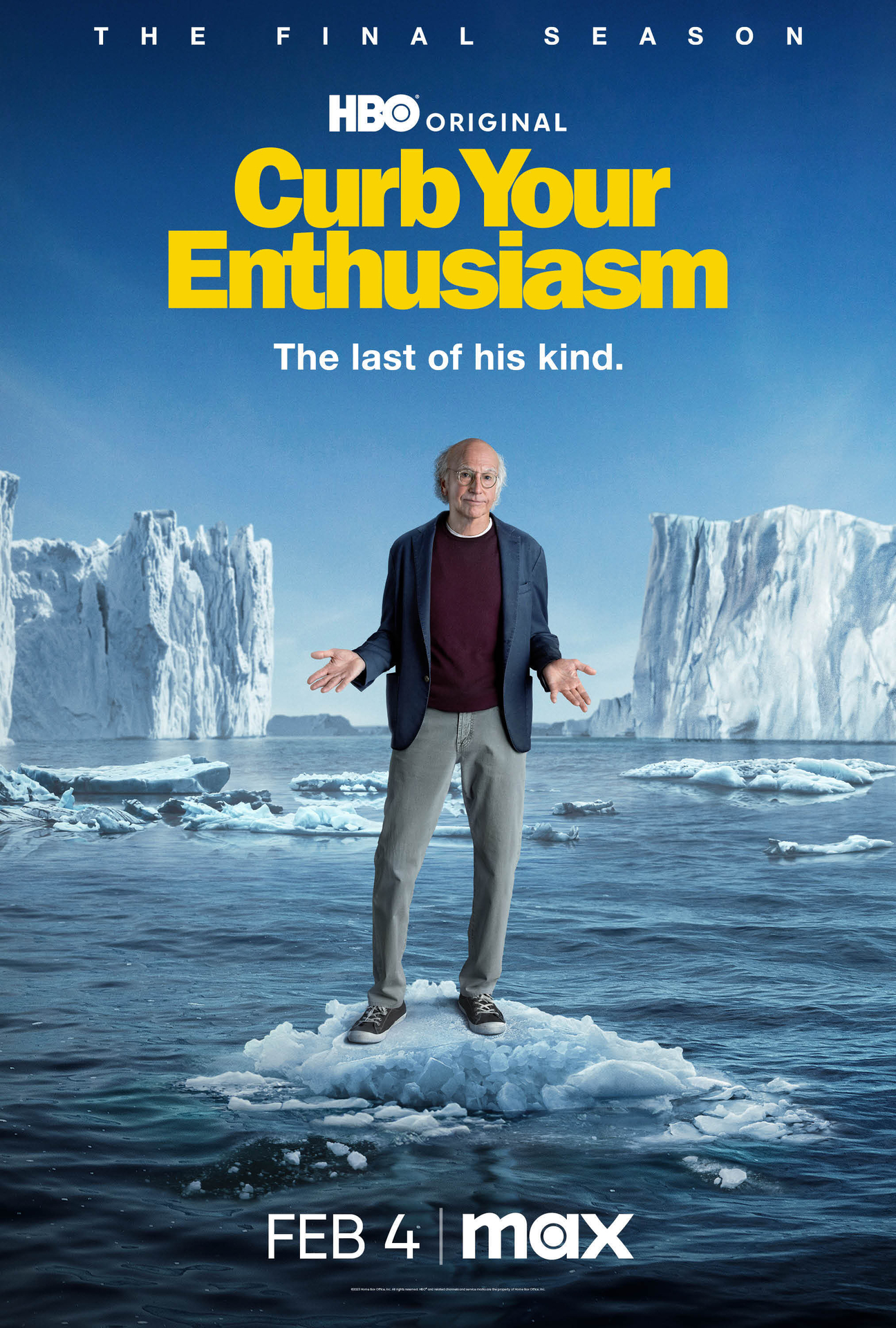

Curb Your Enthusiasm

Stream the final season on Max.

The Regime

Streaming on Max.

Work With Us

The makers, the storytellers, the world's greatest creators. We're bringing together the scripted and the unscripted, the local and the global, the timely and the timeless. Taking the world's greatest possibilities and making them a reality. Creating impact, inspiring imagination, and building connections. Here you can succeed, here you are supported, here you are celebrated.

Warner Bros. Discovery hires talent across the globe and offers career-defining positions, carefully curated benefits, and the tools to realize your best self.

From brilliant creatives to technology trailblazers and beyond, work with us.